Hamza Asumah, MD, MBA

In the ever-evolving landscape of healthcare, innovative payment models have emerged as a transformative force, fundamentally altering how care is delivered and compensated. The shift from traditional fee-for-service (FFS) models to value-based care (VBC) and direct primary care (DPC) exemplifies a significant pivot towards quality, efficiency, and patient-centered services. For healthcare startups navigating this dynamic terrain, understanding the operational implications of these models is crucial for sustainability and growth. This comprehensive analysis dives into the intricacies of VBC and DPC, supported by relevant data and research, to elucidate their impact on the operational strategies of healthcare startups.

Photo By Brookings Institution

Value-Based Care: A Data-Driven Paradigm

Value-based care has surged to the forefront of the healthcare payment reform movement, incentivizing providers to enhance the quality of care rather than the quantity. Under VBC, providers are rewarded for helping patients improve their health, reduce the incidence and impact of chronic disease, and live healthier lives in an evidence-based way.

The Shift to VBC: An Operational Challenge and Opportunity

For startups, the transition to VBC requires a comprehensive rethinking of operations. A 2021 report by McKinsey & Company highlighted that embracing VBC could potentially save the U.S. healthcare system $1 trillion over the next decade. To tap into this potential, startups must invest in robust data analytics capabilities. Predictive modeling and real-time data monitoring become essential for identifying at-risk populations, preventing hospital readmissions, and managing chronic diseases effectively.

Photo By Brookings Institution

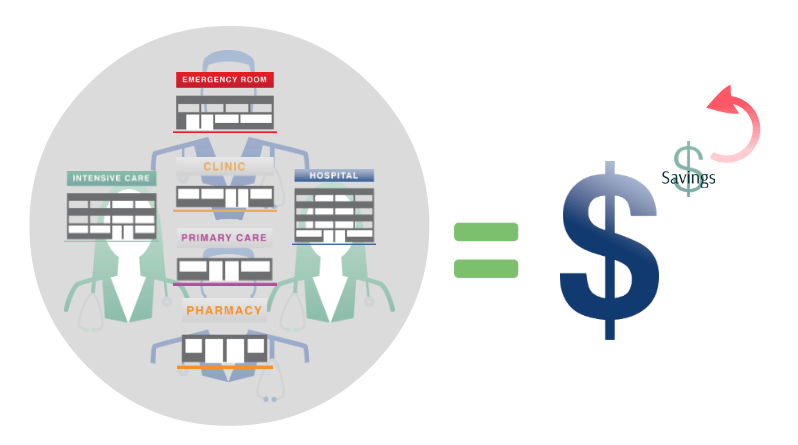

Integrated Care Delivery

VBC models demand a more integrated approach to care delivery. Startups must foster collaborations with various healthcare entities, including hospitals, specialized care providers, and post-acute care facilities. These partnerships are critical in creating a seamless continuum of care, which is a cornerstone of VBC. Operational strategies must include the development of inter-operable electronic health records (EHR) systems and the facilitation of multi-directional data flows.

Patient Engagement Strategies

Patient engagement is another operational area where startups must excel. VBC’s success hinges on patient compliance and preventive care, which requires startups to innovate in patient education, communication, and health literacy initiatives. Tailoring patient engagement strategies to diverse populations will be vital, ensuring that interventions are culturally sensitive and accessible.

Direct Primary Care: A Personalized Approach

Direct primary care is a model where patients pay a monthly, quarterly, or annual fee directly to the provider or practice, bypassing traditional insurance billing. This model allows for enhanced patient-provider relationships and often results in better patient satisfaction and health outcomes.

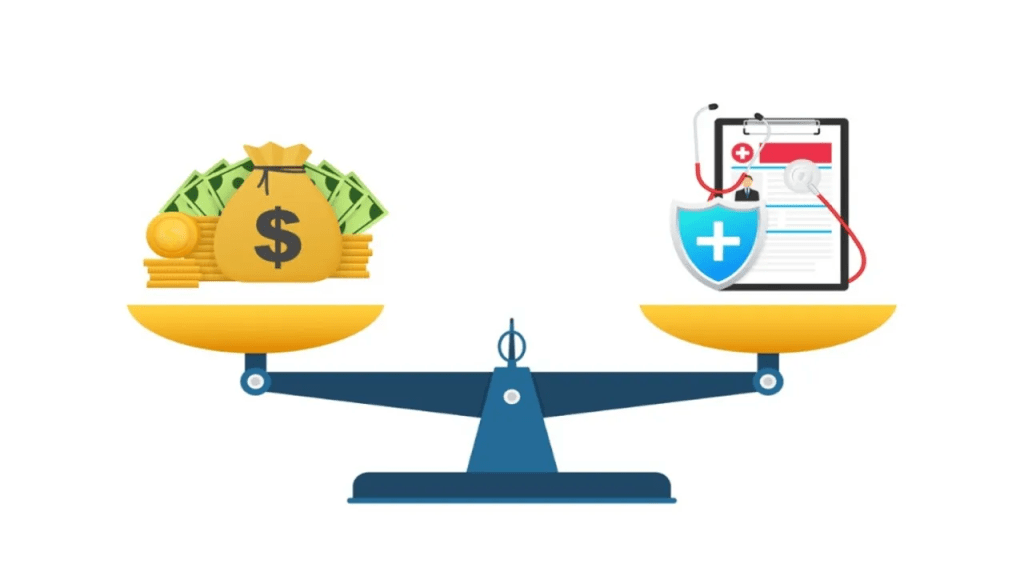

Financial Considerations for Startups

DPC requires a different operational mindset compared to traditional healthcare businesses. For one, startups must be adept at subscription-based revenue models. A study published in the Journal of the American Board of Family Medicine in 2020 found that DPC practices have lower overhead costs and can operate with smaller patient panels while maintaining profitability. Effective financial management systems are critical to monitor cash flows and ensure the sustainability of the practice.

Photo By The Hill

Marketing and Patient Acquisition

Marketing strategies for DPC startups focus on demonstrating the value proposition to potential patients. Clear communication of the benefits, such as longer appointment times, same-day access, and a focus on preventive care, is essential. Startups must leverage digital marketing, community outreach, and patient testimonials to build their practice.

Regulatory Compliance and Risk Management

Both VBC and DPC models require a keen understanding of the regulatory environment. For instance, VBC models often involve navigating complex contracts with payers that include performance benchmarks and shared savings arrangements. Startups must comply with federal programs like the Medicare Access and CHIP Reauthorization Act (MACRA) and its Merit-based Incentive Payment System (MIPS), which reward high-value, high-quality care with payment adjustments. Understanding these regulations and incorporating them into operational workflows without compromising care delivery is a delicate balance that startups must achieve.

DPC, on the other hand, operates outside the traditional insurance framework, which offers some insulation from billing-related regulations. However, startups must still be mindful of healthcare laws such as the Affordable Care Act (ACA), state insurance regulations, and tax implications for their patients. Many DPC providers also need to establish clear contracts to clarify the scope of services covered by the patient’s fee, ensuring transparency and legal compliance.

Technology Integration in DPC Startups

Technology plays a significant role in DPC startups, where the focus on patient-doctor relationships means that administrative tasks must be streamlined for efficiency. Innovative patient management platforms that integrate scheduling, billing, electronic medical records, and telehealth can differentiate a startup in a competitive market. A 2022 survey from Deloitte revealed that patients are increasingly comfortable with digital health solutions, with 57% of respondents willing to use telehealth services. DPC startups that effectively implement these technologies can enhance patient experience and operational efficiency.

Implications for Startup Growth and Scaling

Both VBC and DPC models come with distinct challenges and opportunities for startups aiming to scale. In VBC, scalability is often contingent on data infrastructure that can handle increased patient volumes without sacrificing the quality of analytics. As startups expand, they must maintain the integrity of their care coordination and outcomes measurement to ensure continued participation in value-based programs.

In DPC, scaling requires careful patient panel management to maintain the personalized care that is the hallmark of the model. Startups must balance growth with the capacity to deliver on the promise of direct, unhurried interactions with patients. Additionally, DPC practices looking to expand geographically must navigate varying state regulations that can affect their operations.

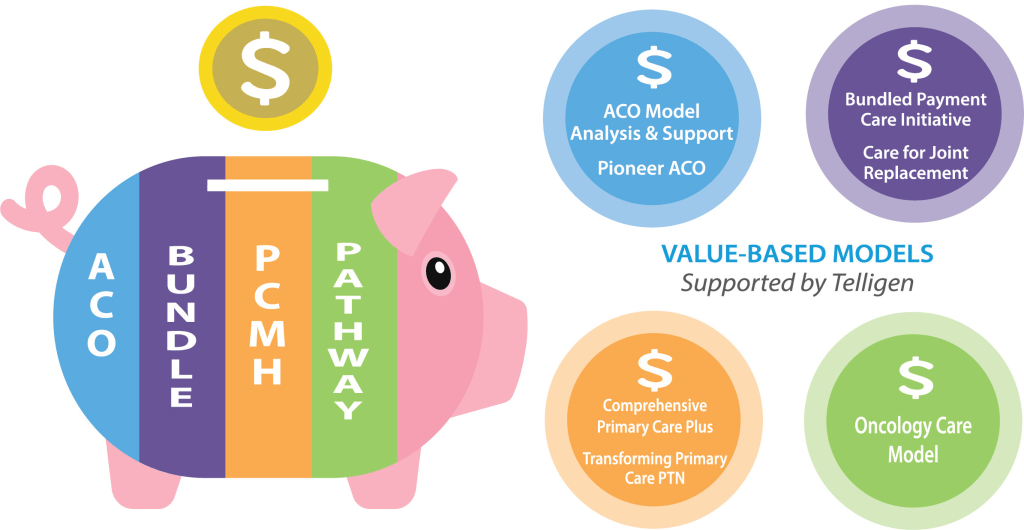

Photo By Telligen

Healthcare startups operating within these innovative payment models have the opportunity to be at the vanguard of a health system that prioritizes value and patient-centricity. By embracing data analytics, focusing on integrated care delivery, and enhancing patient engagement, startups can align their operational strategies with the goals of VBC. Similarly, by mastering subscription-based revenue models, excelling in patient communication, and leveraging technology, DPC startups can capitalize on the demand for personalized primary care.

As the healthcare industry continues to transition away from volume-based reimbursement, startups that successfully navigate these operational implications will not only thrive financially but will also contribute to the larger goal of improving healthcare outcomes for all. With the right mix of innovation, strategic planning, and patient-focused care, healthcare startups can lead the charge in this new era of healthcare payment models.

Please leave your feedback in the comment section below

Leave a comment