Hamza Asumah, MD, MBA

Technology adoption in Africa is on a steady upward trajectory, with significant growth expected in areas such as internet and mobile phone penetration, e-commerce, digital financial services, and renewable energy. Over the next decade, technology will continue to play a critical role in driving economic growth, improving access to essential services, and enhancing the quality of life for millions of people across the continent.

Fintech companies are businesses that leverage digital technologies to provide financial products and services. The term “fintech” is short for “financial technology.” These companies use technologies such as mobile apps, online platforms, and artificial intelligence to deliver financial services that are more efficient, accessible, and affordable than traditional banking services.

Photo By AAMC

Fintech companies offer a wide range of financial products and services, including mobile payments, digital lending, crowdfunding, investment management, insurance, and cryptocurrency. Many fintech companies focus on providing services to underserved populations, such as the unbanked or underbanked, who may not have access to traditional banking services.

Fintech companies have disrupted the traditional banking industry by providing more accessible and innovative financial services. They have also helped to increase competition in the financial sector, driving down costs and improving the quality of financial services for consumers.

The trend of fintech companies in Africa has a strong connection with the growth of telemedicine companies in the region. Both fintech and telemedicine companies are leveraging digital technologies to provide innovative and accessible services to people who may have been excluded from traditional systems.

In particular, the growth of fintech companies in Africa has enabled telemedicine companies to offer their services to a wider audience. By leveraging mobile money and other digital payment platforms, telemedicine companies can offer their services to people who may not have access to traditional banking services. This has been particularly important in rural and remote areas, where people may have limited access to healthcare facilities.

Photo By Disrupt Africa

Similarly, the growth of telemedicine companies has created new opportunities for fintech companies to offer their services. For example, telemedicine companies may require financing to expand their operations or develop new technologies. Fintech companies can provide digital lending and investment services to help these companies grow and innovate.

The relationship between fintech and telemedicine companies in Africa is also driving innovation in both industries. For example, some fintech companies are developing digital health financing platforms that enable patients to access healthcare services on credit. This allows patients to pay for healthcare services over time, rather than upfront, which can be particularly helpful for those who may not have the financial resources to pay for healthcare services upfront. Similarly, telemedicine companies are partnering with fintech companies to develop new payment and financing models that make healthcare services more accessible and affordable for patients.

Overall, the trend of fintech companies in Africa is closely related to the growth of telemedicine companies, and the two industries are working together to provide innovative and accessible services to people across the continent.

Photo By Business Day

Research has shown that digital finance companies have had a positive impact on financial inclusion in Africa. For example, a study by the World Bank found that the adoption of mobile money services in Sub-Saharan Africa increased financial inclusion by 22% between 2014 and 2017. Similarly, a report by the International Finance Corporation found that digital lending platforms have helped to increase access to credit for small and medium-sized enterprises (SMEs) in Africa.

In addition to improving financial inclusion, digital finance companies have also helped to drive innovation and competition in the finance sector. By leveraging digital technologies, these companies are able to offer new and innovative financial products and services that may not have been available through traditional banks. This has led to increased competition, which has in turn led to lower costs and improved quality of financial services for consumers.

Overall, the emergence of digital finance companies in Africa has had a significant impact on the finance sector, improving financial inclusion, driving innovation, and increasing competition. As these companies continue to grow and expand, they are likely to play an increasingly important role in shaping the future of finance in Africa.

Photo By Tech Crunch

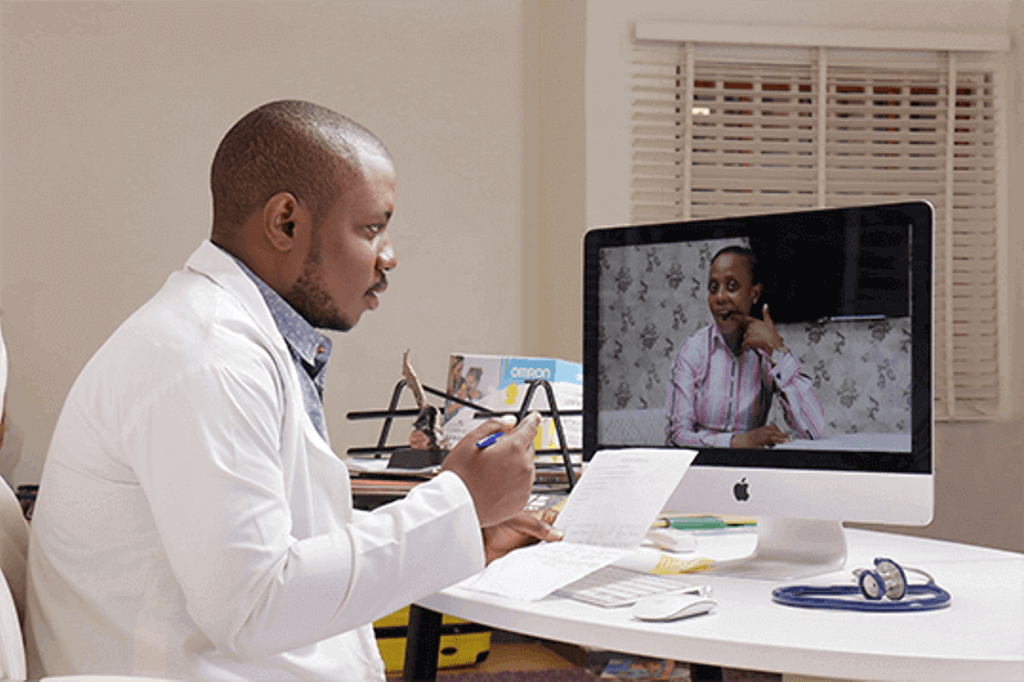

Digital finance platforms have played a critical role in the growth of the telemedicine industry in Africa by providing a reliable and secure means of payment for medical consultations and services. In many African countries, traditional payment methods such as cash and checks are still widely used and may not be suitable for online transactions, especially for those who are unbanked or underbanked. Digital finance platforms, on the other hand, provide a way for patients to make payments for telemedicine services using their mobile phones or other digital devices, regardless of whether they have a bank account or not.

In addition to providing a secure and efficient means of payment, digital finance platforms have also enabled telemedicine providers to reach a wider audience by facilitating transactions across borders and currencies. This has been especially important in Africa, where many people live in rural or remote areas that lack access to traditional healthcare services. By leveraging digital finance platforms, telemedicine providers can offer their services to patients in these areas, who may not have been able to access healthcare otherwise.

Photo By MDPI

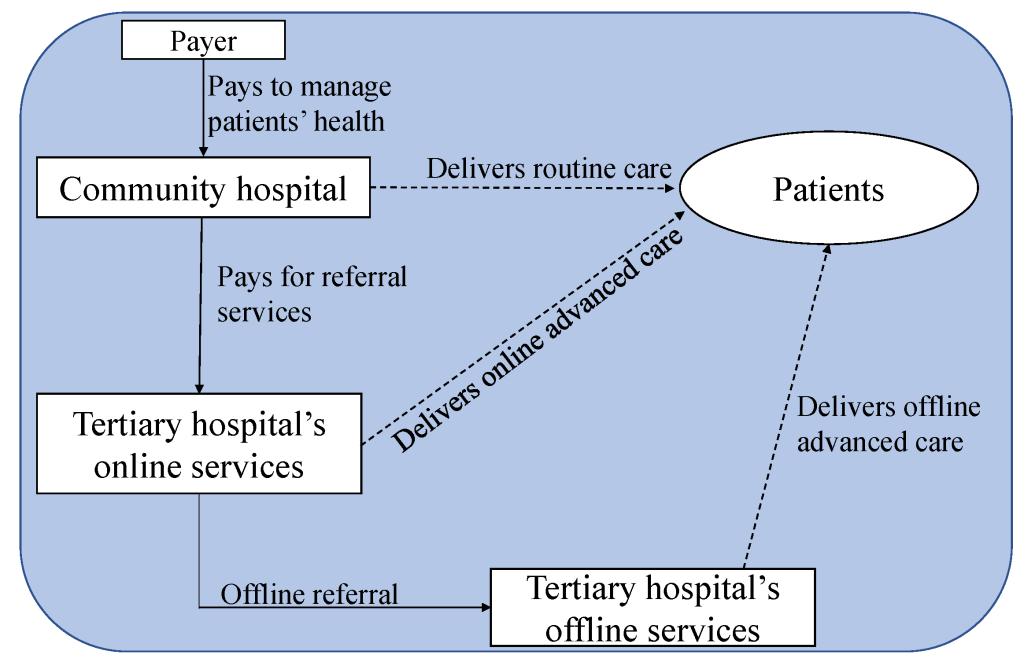

Strategic partnerships between telemedicine providers and digital finance platforms can also help to drive growth in the industry. For example, telemedicine providers can partner with mobile network operators to offer their services on mobile platforms, which are widely used across Africa. This can help to increase the visibility and accessibility of telemedicine services, particularly in rural and remote areas. Additionally, digital finance platforms can provide telemedicine providers with valuable data and insights into patient behavior and preferences, which can be used to improve the quality and effectiveness of their services.

Overall, digital finance platforms have played a critical role in the growth of the telemedicine industry in Africa by providing a secure and efficient means of payment and enabling telemedicine providers to reach a wider audience. Strategic partnerships between telemedicine providers and digital finance platforms can help to drive further growth and innovation in the industry, ultimately improving healthcare outcomes for patients across the continent.

Please leave your insights in the comment section below.

Leave a comment