Hamza Asumah, MD, MBA

Entrepreneurship in Africa’s healthcare sector is a challenging yet vital endeavor. According to a 2021 report from the World Bank, healthcare entrepreneurship has the potential to significantly contribute to the continent’s healthcare system’s resilience and inclusivity. However, the reality remains that a significant number of these ventures fail.

Photo By Duncan Financial Group

This stark reality underscores the importance of recognizing when a venture is failing. In this blog post, we will delve into key red flags that signal a healthcare enterprise’s potential downfall and explore data that substantiate these warning signs. Additionally, we will examine the psychological concepts of ‘escalation of commitment to a losing course of action’ and ‘sunk cost fallacy,’ both of which often contribute to prolonging the life of a venture past its viable lifespan. Understanding and identifying these factors can significantly enhance the decision-making process when navigating the often-tumultuous waters of healthcare entrepreneurship in Africa.

Red Flag 1: Unsustainable Operating Costs

A primary red flag is when operating costs begin to outpace revenue consistently. In a 2019 study by McKinsey, it was found that over 50% of healthcare startups in Africa fail due to high operating costs relative to their income. The high costs often result from factors such as expensive medical equipment, high utility bills, and relatively high costs of human resources. Without a sustainable revenue model or the ability to control expenses, the venture may face financial difficulties that hinder its long-term viability.

Photo By Moved Back

Red Flag 2: Regulatory Constraints

Regulatory constraints can significantly hamper a healthcare venture’s progress. A 2021 World Bank report showed that African healthcare startups often struggle with getting the necessary licenses and meeting the regulatory standards of their respective countries. Compliance with these regulations can be time-consuming and costly, creating barriers to entry and expansion. If the venture finds itself continuously entangled in regulatory issues without a clear path forward, it may be an indication that it’s time to reassess its viability.

Red Flag 3: Inadequate Market Demand

Despite the high demand for quality healthcare in Africa, specific services or products may not gain traction due to cultural preferences, market saturation, or a lack of public awareness. A 2022 study published in The Lancet showed that about 30% of healthcare startups in Africa fail due to inadequate market demand for their services or products. It is crucial for entrepreneurs to thoroughly understand the target market and ensure that there is a genuine need for their offerings. If the venture struggles to attract customers or fails to generate sufficient demand, it may be an indication that pivoting or exiting the market is necessary.

Photo By Can Stock

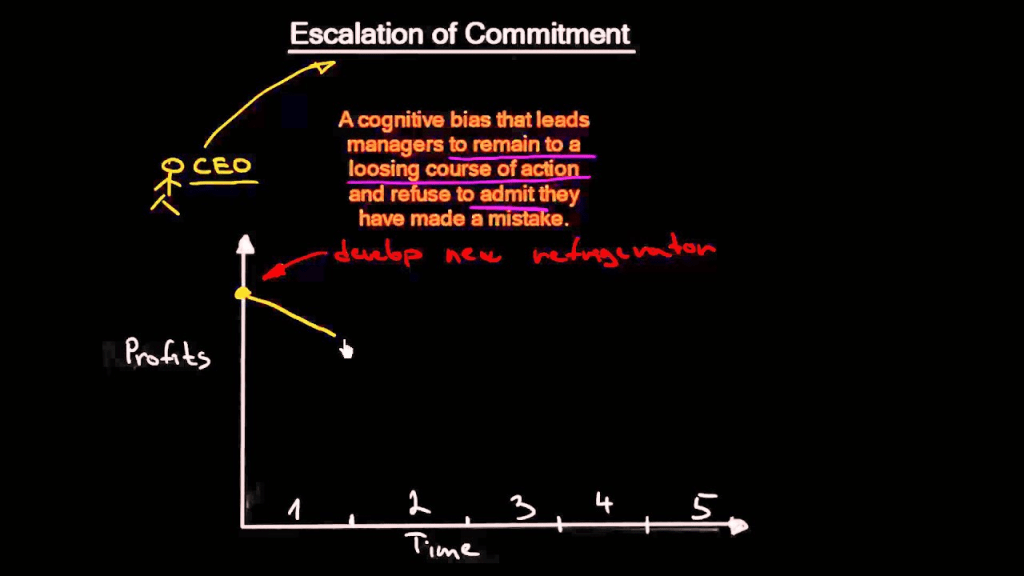

Escalation of Commitment to a Losing Course of Action:

Recognizing these red flags can be challenging due to psychological biases, such as the escalation of commitment to a losing course of action. This concept describes a situation where entrepreneurs continue to invest more resources into a failing venture, hoping that the situation will improve. The fear of failure and the emotional attachment to the initial idea can cloud judgment and lead to a vicious cycle of increasing losses. Entrepreneurs must regularly evaluate the venture’s performance objectively and be willing to pivot or abandon if the evidence suggests that it is no longer viable.

Photo By Organizing 4Innovation

The cycle of escalation of commitment to a losing course of action can be illustrated through several stages, each building upon the previous one. Let’s explore these stages:

1. Initial Decision: At the beginning of the cycle, a decision is made to pursue a particular course of action or project. This decision is often based on careful analysis, available information, and expectations of success.

2. Early Results: After initiating the chosen course of action, initial results are observed. If these results align with expectations and show signs of progress, it reinforces the commitment to continue. However, if the early results are not as anticipated, doubts may start to emerge.

3. Cognitive Dissonance: When faced with negative or unexpected outcomes, individuals may experience cognitive dissonance. They may feel a tension between the initial decision and the emerging evidence that suggests a different approach may be necessary. This discomfort motivates them to seek ways to justify their previous decisions and investment.

4. Increased Investment: To resolve cognitive dissonance and validate their initial decision, individuals tend to increase their investment in the failing course of action. This can manifest as allocating more resources, investing additional time and effort, or seeking external support. The belief is that by investing more, the situation will eventually turn around.

5. Escalation: As the commitment deepens, individuals become more emotionally attached to the chosen course of action. They may become overly optimistic, disregarding warning signs and dismissing alternative viewpoints or feedback. This escalation can lead to a tunnel vision effect, where individuals focus solely on their initial decision and become resistant to change.

6. Loss Aversion: One of the psychological factors that contribute to escalation of commitment is loss aversion. People tend to be more motivated to avoid losses than to achieve gains. Even in the face of mounting evidence that the chosen course of action is failing, individuals may be reluctant to abandon it due to the fear of admitting failure and incurring loss.

7. Point of No Return: Eventually, the commitment reaches a point of no return, where the investment becomes so substantial that it is difficult to justify abandoning the failing course of action. This can be due to financial, emotional, or reputational reasons. The sunk costs, both tangible and intangible, make it increasingly challenging to change direction.

8. Failure and Acceptance: Finally, the course of action ultimately fails, often resulting in significant negative consequences. At this stage, individuals may acknowledge the failure and accept that continuing further would be futile. However, the realization of the losses incurred and the impact of the failure can be emotionally challenging.

Breaking the cycle of escalation of commitment requires self-awareness, the ability to objectively evaluate evidence, and a willingness to adapt and change course when necessary. It is crucial to learn from past mistakes and make decisions based on current information and analysis rather than being bound by sunk costs and emotional attachment to a failing course of action.

Photo By Youtube

Sunk Cost Fallacy:

Similarly, the sunk cost fallacy can also distort decision-making. This occurs when entrepreneurs continue investing in a failing venture because of the costs they’ve already incurred, which they consider unrecoverable. It’s crucial to understand that sunk costs should not influence future investment decisions as they are past expenses and cannot be recovered. Instead, decisions should be based on future projections and the potential return on investment. Letting go of sunk costs can be difficult, but it is essential to make rational decisions that prioritize long-term success over emotional attachment to past investments.

Photo By Discover Magazine

Here’s an illustration of the cycle of the sunk cost fallacy:

1. Initial Investment: The cycle begins when an individual or organization makes an initial investment in a project, whether it’s financial resources, time, or effort. This investment is based on the belief that the project will be successful and yield positive returns.

2. Evidence of Problems: As the project progresses, evidence may emerge indicating that it is not meeting expectations or facing significant challenges. This evidence might include missed deadlines, cost overruns, or changing market conditions. These problems suggest that the project may not achieve the desired outcomes.

3. Awareness of Losses: At this stage, individuals become aware of the resources already invested in the project. They realize that significant time, money, and effort have already been expended, leading to a sense of loss aversion. They become reluctant to abandon the project because doing so would mean admitting that the previous investments were wasted.

4. Justification and Rationalization: To justify the continued investment, individuals may engage in rationalization. They downplay the significance of the problems, convince themselves that success is just around the corner, or attribute the difficulties to temporary setbacks. This rationalization helps them maintain the belief that the project is still worth pursuing, despite mounting evidence to the contrary.

5. Escalation of Commitment: The commitment to the project escalates as individuals feel compelled to invest even more resources to salvage what has already been invested. They believe that by increasing the investment, they can overcome the challenges and eventually achieve success. This escalation can lead to a vicious cycle where more resources are poured into a failing project.

6. Overcoming the Fallacy: Breaking the sunk cost fallacy requires recognizing that the resources already invested are irretrievable and should not be the sole basis for decision-making. It involves shifting the focus from past investments to future prospects and potential returns. Objective evaluation of the current situation, weighing the costs and benefits, and considering alternative courses of action are essential to overcome the fallacy.

7. Acceptance and Learning: Eventually, individuals may come to accept that the project is no longer viable or worthwhile. This acceptance can be accompanied by a realization that the sunk cost fallacy has influenced their decision-making. Learning from this experience is crucial, as it helps individuals avoid similar pitfalls in future projects and make more rational decisions based on objective analysis.

By understanding the sunk cost fallacy and being mindful of its influence, individuals and organizations can make more informed decisions, cut their losses when necessary, and allocate resources more effectively.

Photo By Investopedia

Historical Perspective:

When we look at the history of healthcare ventures in Africa, we can see patterns in their failure cycles. A historical analysis can help us further understand the red flags and the psychological traps that entrepreneurs often fall into.

For instance, the 2015-2017 period saw a boom in telemedicine startups across Africa, driven by the promise of technology to bridge the healthcare gap. However, as a 2018 study by the African Journal of Business Management shows, many of these startups failed within the first three years. The study attributed the high failure rate to unsustainable operating costs, lack of regulatory clarity, and insufficient market demand – the same red flags we’ve discussed earlier.

Interestingly, the study also noted that many entrepreneurs continued to invest in these ventures long after it was clear that the business model was not sustainable. This aligns with the psychological concept of escalation of commitment to a losing course of action. The sunk cost fallacy was also evident as many entrepreneurs were unwilling to abandon the venture due to the significant investments they had already made.

In contrast, successful healthcare ventures during this period were those that quickly recognized these red flags and took corrective action. They pivoted their business models, sought regulatory advice, and engaged in extensive market research to understand the needs of their target audience better.

Another historical example is the wave of private clinics that sprung up across Africa in the early 2000s. While some became successful, many failed due to the high costs of setting up and running a clinic and the fierce competition in urban areas. Again, the ventures that survived were those that adapted their business models, found niche markets, or moved to underserved rural areas.

Photo By Wall Street Mojo

In conclusion, the journey of healthcare entrepreneurship in Africa is fraught with challenges. Recognizing the red flags early can save valuable time, capital, and energy. Understanding the psychological traps such as the escalation of commitment to a losing course of action and the sunk cost fallacy can help entrepreneurs make more objective decisions. Historical examples illustrate that success often comes to those who can adapt their business models and strategies in response to these red flags.

Abandoning a failing venture is not admitting defeat, but rather a strategic move that can free up resources for more promising opportunities. It requires courage, objectivity, and a deep understanding of the market and regulatory environment. Ultimately, it allows entrepreneurs to learn from their failures and apply these lessons to future ventures, contributing to a more robust and resilient healthcare ecosystem in Africa.

Please leave your insights in the comment section below.

Leave a comment