Hamza Asumah, MD, MBA

Health insurance AR, also known as healthcare accounts receivable, is a term used to describe the amount of money owed to a hospital or healthcare provider by health insurance companies for the services they have provided to patients covered by those insurance plans.

When a patient receives medical treatment at a hospital or healthcare facility, the healthcare provider bills the patient’s health insurance company for the services provided. If the insurance company does not pay the full amount owed for the services, the remaining balance is recorded as an account receivable. This outstanding balance is referred to as health insurance AR.

Health insurance AR is an important metric for hospitals and healthcare providers to track because it can impact their cash flow and financial performance. If the amount of outstanding payments is high, it can indicate that the hospital is facing financial challenges. On the other hand, if the amount of outstanding payments is consistently low, it can indicate that the hospital has effective billing and collection processes in place.

Photo by Kauvery Hospital

Managing huge insurance accounts receivable (AR) and delayed insurance payments is a common challenge faced by hospitals and healthcare providers in Africa. Insurance companies often delay payments due to various reasons, such as incomplete or incorrect claim information, slow processing times, lack of funds or disputes over the validity of the claim. These delays can cause significant cash flow problems for hospitals, which can impact their ability to provide quality care to patients and manage their daily operations effectively. In this blog, we will discuss some tips on how hospitals in Africa can manage their insurance AR and delayed payments.

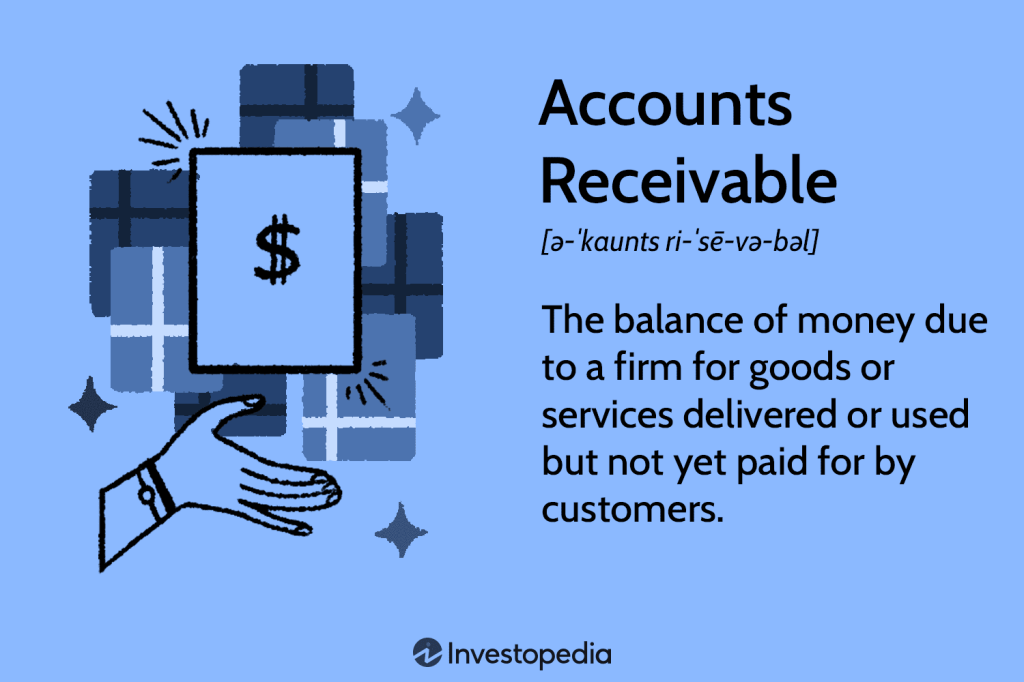

Photo By Investopedia

The average wait times for insurance payments to hospital businesses in Africa can vary widely depending on various factors such as the type of insurance, the insurance company’s policies and procedures, the complexity of the claims submitted, and the efficiency of the hospital’s billing and collection processes.

In some cases, insurance payments to hospital businesses in Africa may be processed quickly and paid within a few days to a few weeks. However, in other cases, insurance payments may be delayed for several months or even longer, causing significant cash flow challenges for hospitals and healthcare providers.

One of the reasons for delayed insurance payments in Africa is the inefficiency and complexity of the claims processing and payment systems. In many cases, insurance companies in Africa still rely on manual processes, which can be time-consuming and error-prone. Additionally, there may be a lack of communication and coordination between hospitals, healthcare providers, and insurance companies, which can further delay insurance payments.

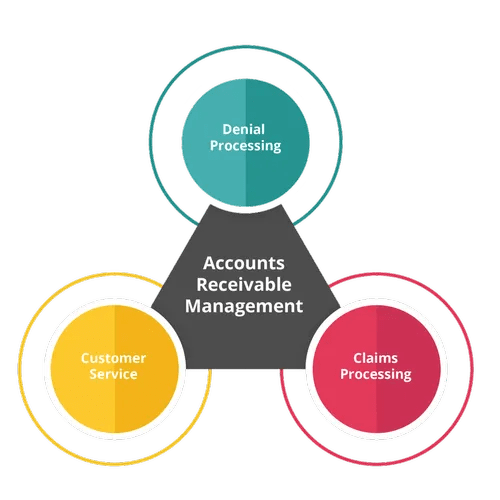

Photo By India Mart

Delayed insurance payments and accounts receivable (ARs) can have a significant impact on hospital growth and financial performance. Here are some key data points that highlight this impact:

- Decreased cash flow: When insurance payments are delayed, hospitals may experience decreased cash flow, which can limit their ability to invest in new equipment, hire additional staff, or expand services. According to a survey by the Medical Group Management Association (MGMA), 70% of medical practices reported that delayed payments negatively impacted their cash flow.

- Increased AR days: Delayed insurance payments can also lead to an increase in AR days, which can impact a hospital’s financial performance. According to a report by Advisory Board, hospitals with poor revenue cycle management may have an average AR days of up to 75 days, compared to a benchmark of 40-50 days.

- Increased bad debt: When insurance payments are delayed, hospitals may be forced to write off unpaid balances as bad debt, which can negatively impact their financial performance. According to a report by Kaufman Hall, the average bad debt rate for hospitals in the US was 8.1% in 2020, representing a significant financial loss.

- Reduced investment and growth: Delayed insurance payments and high ARs can limit a hospital’s ability to invest in new services, equipment, or facilities, which can impact long-term growth and competitiveness. According to a report by Black Book Market Research, hospitals with inefficient revenue cycle processes may experience up to 12% lower revenue growth than those with effective processes.

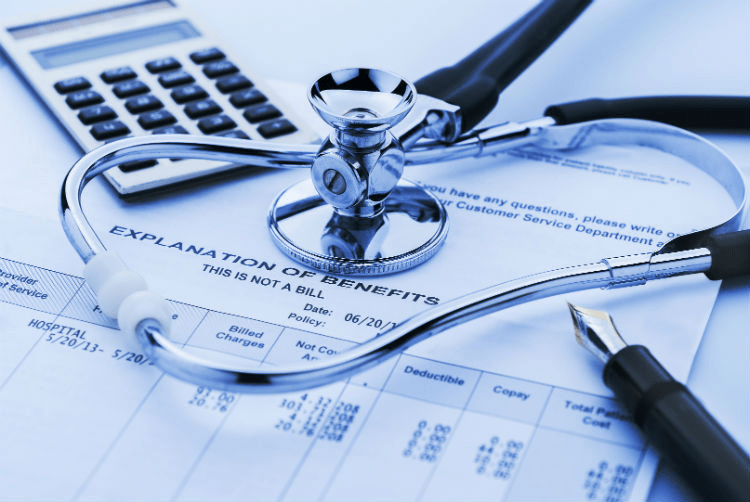

Photo By Aging Care

The following are ways to reduce delays in insurance payments while ensuring that your insurance AR is well controlled

1. Verify insurance coverage before providing services:

Before providing any services to a patient, it is essential to verify their insurance coverage and eligibility. This can prevent unnecessary services from being provided to patients who are not covered by their insurance or whose insurance has lapsed. Hospitals can use electronic tools to verify insurance coverage in real-time, which can help reduce errors and delays in the billing process.

2. Submit accurate and complete claims:

Submitting accurate and complete claims is critical to ensuring timely payments from insurance companies. Hospitals should ensure that all required fields are completed and that all necessary documentation is included with the claim. This can help prevent delays in the processing of the claim and reduce the likelihood of the claim being rejected or denied.

Photo By Black Line

3. Follow up on unpaid claims:

Hospitals should have a system in place to track unpaid claims and follow up with insurance companies on a regular basis. This can help identify and resolve any issues with the claim, such as missing information or disputes over the validity of the claim. It can also help ensure that claims are processed in a timely manner and that payments are received promptly.

4. Consider outsourcing billing and collections:

Outsourcing billing and collections to a third-party service provider can help hospitals manage their insurance AR and delayed payments more effectively. These service providers have expertise in handling insurance claims and can help ensure that claims are submitted accurately and on time. They can also follow up on unpaid claims and work with insurance companies to resolve any disputes or issues.

5. Implement financial policies and procedures:

Hospitals should have clear financial policies and procedures in place to manage their AR and delayed payments effectively. These policies should outline the steps to be taken in the event of delayed payments and provide guidelines for managing AR. They should also include provisions for handling disputes with insurance companies and for appealing denied claims.

Photo By Fierce HealthCare

In conclusion, managing insurance AR and delayed payments is a complex process that requires careful attention and planning. By verifying insurance coverage, submitting accurate and complete claims, following up on unpaid claims, considering outsourcing billing and collections, and implementing financial policies and procedures, hospitals in Africa can better manage their insurance AR and ensure timely payments from insurance companies. This, in turn, can help improve their cash flow, enable them to provide quality care to patients, and manage their daily operations effectively.

Please leave your comments below

Leave a comment